Tips to Effectively Manage Your Household Budgetįollowing these simple tips, you can effectively manage your household budget: Starting from utility bills and ending at planning vacations. There are very small-small expenses which contribute to this list. They need to allocate stipulated amounts to routine expenses and also be prepared for some accidental expenses.Įvery homemaker wishes to have ample cash flow during and at the end of the month. How to use Monthly Household Budget Excel Template?Įvery homemaker/women manage their money very profoundly to balance their target at the end of the month.

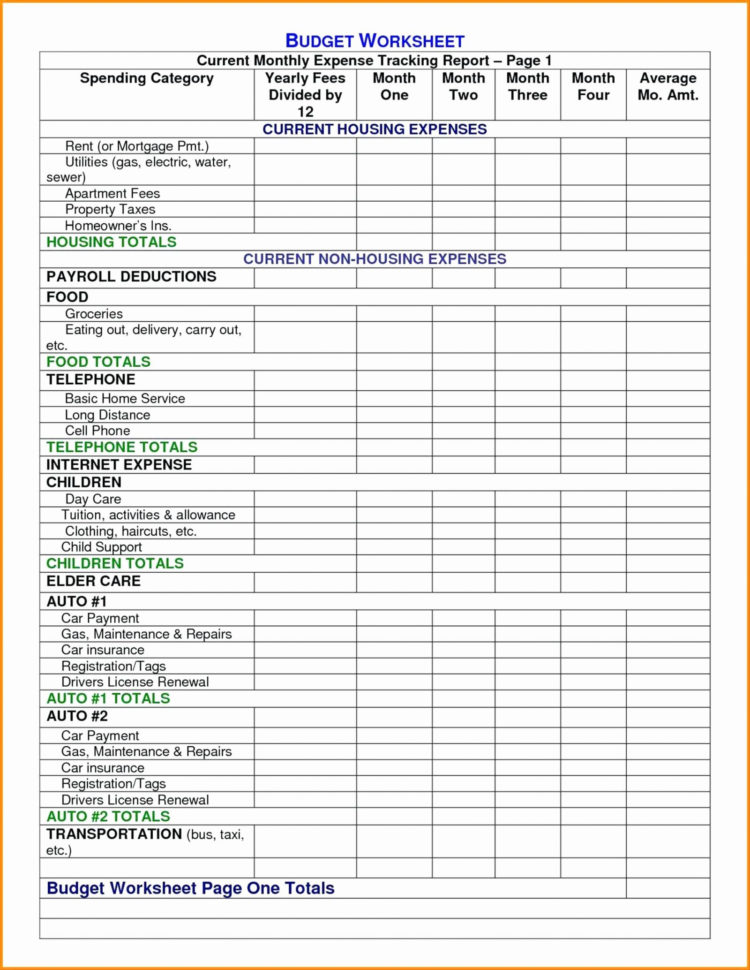

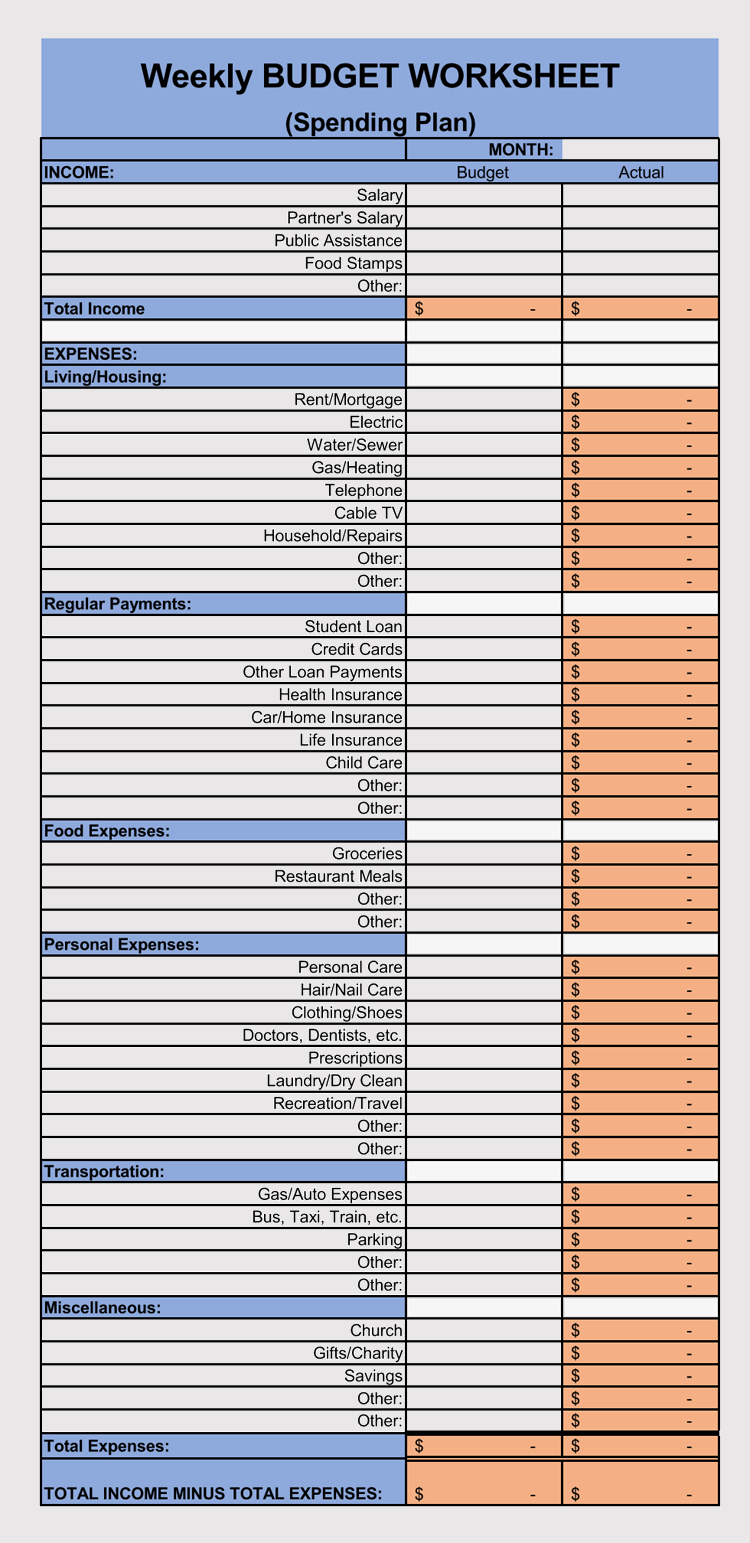

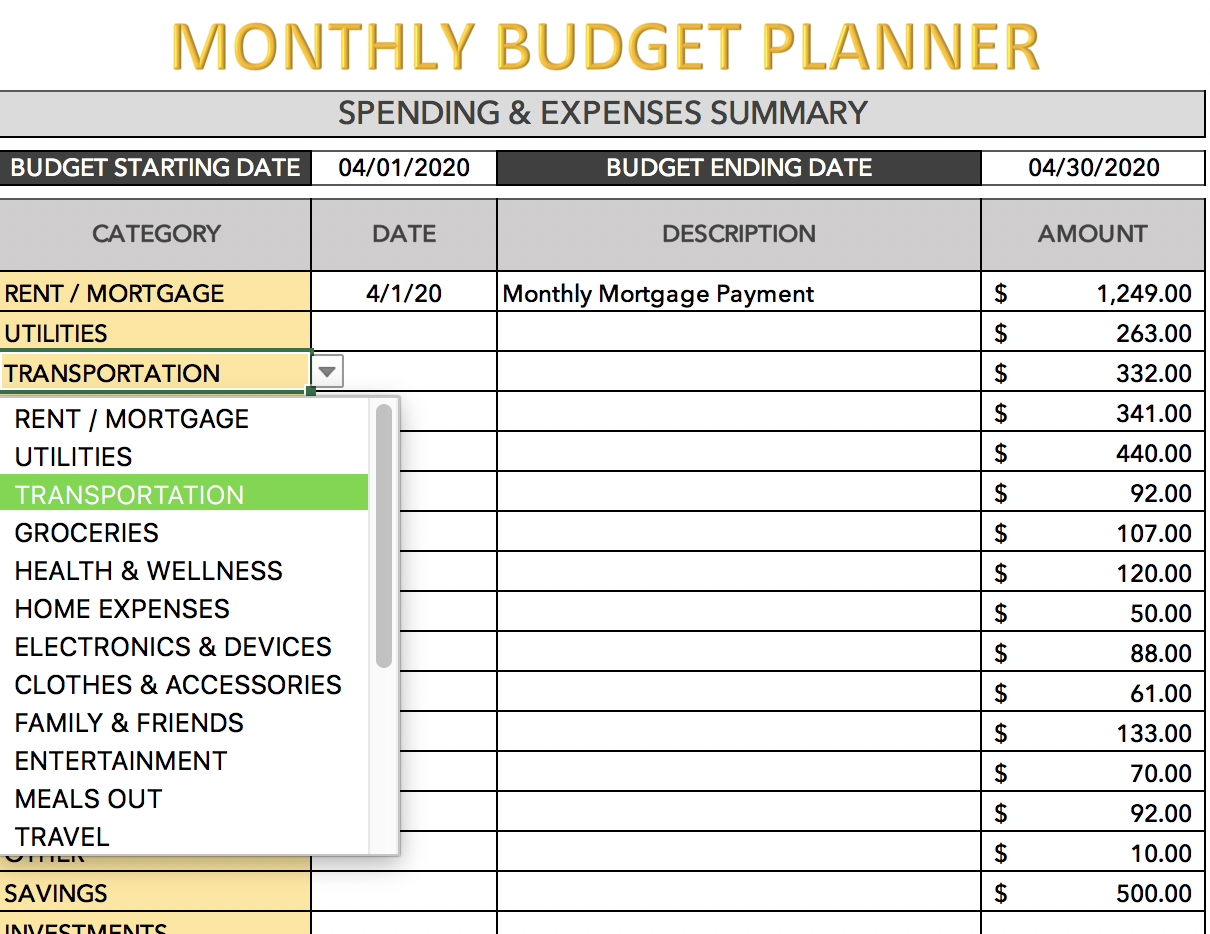

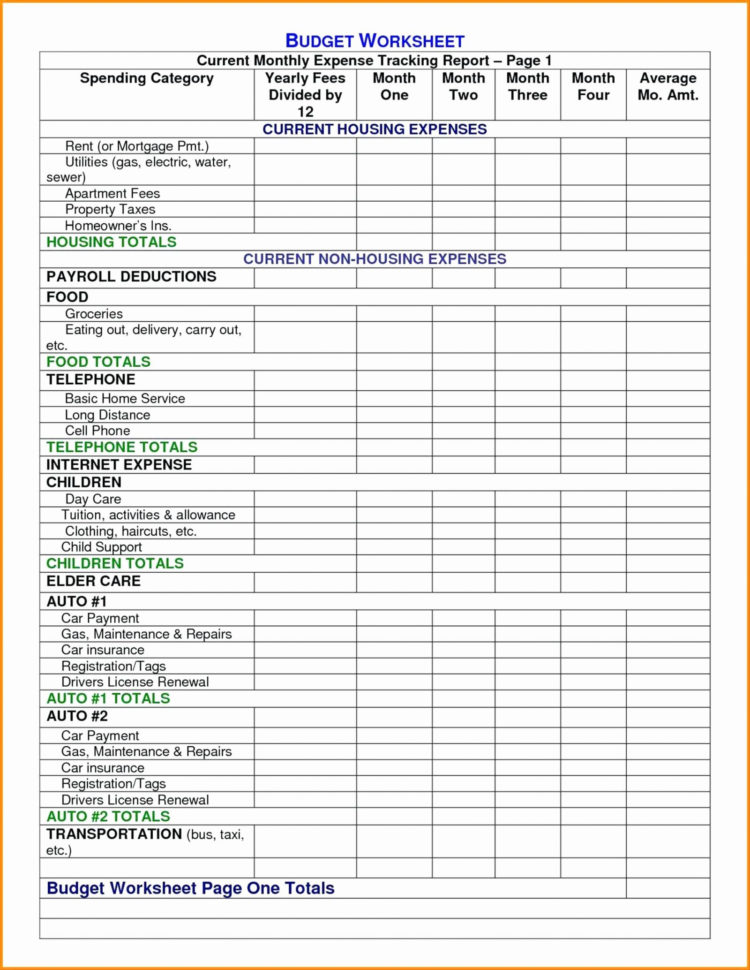

Monthly Household Budget Excel Template. Tips to Effectively Manage Your Household Budget. Here, I created two conditional formatting rules to highlight cells lower than 0 and greater than 0, i.e., a complete net income row. Sometimes, if an expense is more than earnings or income, the negative value appears in the net income row therefore, we should apply conditional formatting to appear as green in color, and negative values cells appear in red. Press Enter, so the result will be as shown below. Simultaneously add total income and expense in cell A2 & A3 and net income OR savings in column A4. Now, enter all the income & expense data in the respective cells.Īddition of Expenses by using Sum FunctionĮnter the SUM function into cell E19, select cell E19, type an equal sign (=), enter SUM (select the expense range for the month of Jan, i.e. Excel automatically adds the other months. Then, select cell B1, click the cell’s lower right corner and drag it across to cell M1. We can all add these categories in excel you can enter the different types of income and expenses category in column B. A health club (Annual or monthly memberships & spendings). Study Loan (Taken during graduation or postgraduation studies). Gifts are given on any wedding or other occasions. Investments & super contributions (Stock market or mutual funds). Paying off debt if you have taken from someone. You should know or be aware of your monthly expenses or spending, which is categorized into various sections. Family benefit payments you have received prior (monthly or annual). Income from savings and investments made (monthly or annual).

Monthly Household Budget Excel Template. Tips to Effectively Manage Your Household Budget. Here, I created two conditional formatting rules to highlight cells lower than 0 and greater than 0, i.e., a complete net income row. Sometimes, if an expense is more than earnings or income, the negative value appears in the net income row therefore, we should apply conditional formatting to appear as green in color, and negative values cells appear in red. Press Enter, so the result will be as shown below. Simultaneously add total income and expense in cell A2 & A3 and net income OR savings in column A4. Now, enter all the income & expense data in the respective cells.Īddition of Expenses by using Sum FunctionĮnter the SUM function into cell E19, select cell E19, type an equal sign (=), enter SUM (select the expense range for the month of Jan, i.e. Excel automatically adds the other months. Then, select cell B1, click the cell’s lower right corner and drag it across to cell M1. We can all add these categories in excel you can enter the different types of income and expenses category in column B. A health club (Annual or monthly memberships & spendings). Study Loan (Taken during graduation or postgraduation studies). Gifts are given on any wedding or other occasions. Investments & super contributions (Stock market or mutual funds). Paying off debt if you have taken from someone. You should know or be aware of your monthly expenses or spending, which is categorized into various sections. Family benefit payments you have received prior (monthly or annual). Income from savings and investments made (monthly or annual).  Bonuses/overtime worked & payout from the company (monthly). Your partner’s or spouse take-home pay (monthly). You Should Know or Be Aware of Your Monthly Income or Earnings TEXT and String Functions in Excel (26+). Lookup and Reference Functions in Excel (36+). Excel Conditional Formatting Based on Another Cell Value. SUMPRODUCT Function with Multiple Criteria.

Bonuses/overtime worked & payout from the company (monthly). Your partner’s or spouse take-home pay (monthly). You Should Know or Be Aware of Your Monthly Income or Earnings TEXT and String Functions in Excel (26+). Lookup and Reference Functions in Excel (36+). Excel Conditional Formatting Based on Another Cell Value. SUMPRODUCT Function with Multiple Criteria.

Compare Two Columns in Excel for Matches.

0 kommentar(er)

0 kommentar(er)